Home Loan Types

In India, settling down has become synonymous with owning a home. In this busy world, everyone dreams of owning a perfect abode where they can find solace at the end of the day. A home loan is an easy way to fund your house purchase given that it is not a wise idea to burn your entire savings to buy a land or a home.

Banks and other housing finance establishments offer different types of home loans these days. The demand for Home Loan has increased manifold in recent years and people have different expectations when it comes to a home loan.

To cater to the requirements of different sections of society, a lot of banks have come up with this concept of introducing different home loan schemes. To quote a few, several banks offer specially crafted home loans for women and agriculturalists and loans exclusively for the purchase of land.

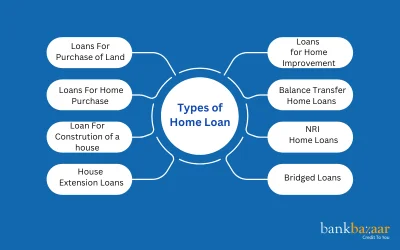

Types of Home Loan:

Lenders offer home loans, not only for buying a house but also for a variety of other purposes. Some of the popular types of home loans available in the financial market are described below.

1. Loans for Purchase of Land

Several banks offer loans for Purchasing a land is a flexible option, the buyer can save funds and construct a house whenever his finances allow or just have the land as an investment. Up to 85% of the cost of the land is given as loan by lenders like Axis Bank.

Eligibility Criteria for Purchase of Land

The following are the eligibility criteria for purchase of land:

Age | Employment |

18 years to 65 years | Salaried, self-employed, Professionals, and Non-Professionals |

Documents Needed for Home Purchase Loan

Given below are the documents that are needed to apply for home purchase loan:

- Proof of Age: Birth certificate, Std.10 marksheet

- Proof of Address: Voter ID card, Aadhar Card, Utility Bills

- Proof of Income: Salary slip, Income Tax Returns (ITR) details

- Identification proof: Permanent Account Number (PAN ) card, Voter ID, Passport

- Property related documents

- Existing loan documents

2. Loans for Home Purchase

The most popular type of home loan is the loan for purchase of a new home or a pre-owned home. This loan is also commonly available and is offered by many banks in different variants. The interest rate is either floating or fixed and generally ranges anywhere between 9.85% and 11.25%. Also, 85% of the total amount is offered as a loan by many banks.

Eligibility Criteria for Home Purchase Loans

The following are the eligibility criteria for home purchase loans:

chase loans:

Particulars | Salaried | Self-Employed |

Age | 18 years to 65 years | 18 years to 65 years |

Employment | Minimum two years of experience | 750 or above |

Credit Score | Minimum five years of experience | 750 or above |

Documents Needed for Home Purchase Loan

Given below are the documents that are needed to apply for home purchase loan:

- Proof of Age: Birth certificate, Std.10 marksheet

- Proof of Address: Voter ID card, Aadhar Card, Utility Bills

- Proof pf Income: Salary slip, Income Tax Returns (ITR) details

- Identification proof: Permanent Account Number (PAN) card, Voter ID, Passport

- Documents of property

- Existing loan documents (if any)

3. Loans for Construction of a House

This loan is specially designed for people who want to construct a place according to their wishes rather than buying a pre-constructed house. The approval process for this type of loan is different for it takes into account the cost of plot also. The most important clause when applying for a home construction loan is that the plot must have been purchased within a year for the plot cost also to be included in the loan amount. The loan amount is decided based on a rough estimate of the construction cost. The amount may be disbursed at one go or in multiple installments. Popular home construction loans include the schemes offered by Bank of Baroda, UCO Bank and Canara Bank.

Eligibility Criteria for a Loan for Construction of a House

The following are the eligibility criteria for home purchase loans:

Particulars | Salaried | Self-Employed |

18 years to 65 years | 18 years to 65 years | |

Employment | Minimum two years of experience | 750 or above |

Credit Score | Minimum five years of experience | 750 or above |

Documents Needed for Loan for Construction of a House

Given below are the documents that are needed to apply for home purchase loan:

- Proof of Age: Birth certificate, Std.10 marksheet

- Proof of Address: Voter ID card, Aadhar Card, Utility Bills

- Proof pf Income: Salary slip, Income Tax Returns (ITR) details

- Identification proof: Permanent Account Number (PAN) card, Voter ID, Passport

- Property related documents

- Existing loan documents (Optional)

4. House Expansion or Extension Loans

Want another balcony or an additional bedroom? No worries, some banks also offer loans for house expansion including alteration of current structure and construction of new rooms. HDFC Home Extension loan and house renovation loan offered by Bank of Baroda are popular in this category.

Eligibility Criteria for Home Expansion or Extension Loans

Given below are the eligibility criteria for home expansion or extension loans:

Age | Employment |

18 years to 65 years | Salaried, Professionals, Non-Professionals, and Self Employed |

Documents Needed for Loan for Construction of a House

Given below are the documents that are needed to apply for home purchase loan:

- Proof of Age: Birth certificate, Std.10 marksheet

- Proof of Address: Voter ID card, Aadhar Card, Utility Bills

- Proof of Income: Salary slip, Income Tax Returns (ITR) details

- Identification proof: Permanent Account Number (PAN) card, Voter ID, Passport

- Existing loan documents

- Home extension or property related documents

5. Loans for Home Improvement

Renovation and repair works like external and internal repair, painting, construction of overhead water tank and electrical renovation certainly will make your house look better. But if you lack the finances for repair and renovation, banks like Union Bank of India, Vijaya Bank offer specialized home improvement loans.

Eligibility for Home Improvement Loan

The following are the criteria for home improvement loan:

Age | Employment |

18 years to 65 years | Salaried, Professionals, Non-Professionals, and Self Employed |

Documents Needed for Loan for Construction of a House

Given below are the documents that are needed to apply for home purchase loan:

- Proof of Age: Birth certificate, Std.10 marksheet

- Proof of Address: Voter ID card, Aadhar Card, Utility Bills

- Proof of Income: Salary slip, Income Tax Returns (ITR) details

- Identification proof: Permanent Account Number (PAN) card, Voter ID, Passport

- Original Property Title Deeds

- Estimated Renovation Quotation

6. Balance Transfer Home Loans

This option can be availed when an individual wants to transfer his home loan from one bank to another bank owing to reasons like lower interest rates or better services offered by the other bank. This is done to repay the remaining loan at a revised, lower interest rates offered by the other lender.

Eligibility Criteria for Balance Transfer Home Loans

The following are the eligibility criteria for balance transfer home loans:

Age | Employment |

18 years to 65 years | Salaried, Professionals, Non-Professionals, and Self Employed |

Documents Needed for Loan for Construction of a House

Given below are the documents that are needed to apply for home purchase loan:

- Proof of Age: Birth certificate, Std.10 marksheet

- Proof of Address: Voter ID card, Aadhar Card, Utility Bills

- Proof of Income: Salary slip, Income Tax Returns (ITR) details

- Identification proof: Permanent Account Number (PAN) card, Voter ID, Passport

- Property related documents

- Bank statement showing repayment of ongoing loan

- Loan statement and list of property documents in possession of the existing lender

7. NRI Home Loans

Specially designed to support non-resident Indians in buying a residential property in India, the formalities and application procedure for this type of loan is different from the others. Generally, most of the private and public sector banks offer NRI loans as a product of their housing loan portfolio.

Eligibility Criteria for NRI Home Loans

The following are the eligibility criteria for NRI Home Loans:

Age | Employment |

18 years to 65 years | Salaried, Professionals, Non-Professionals, and Self Employed |

Documents Needed for Loan for NRI Home Loans

Given below are the documents that are needed to apply for NRI home loan:

- Proof of Age: Birth certificate, Std.10 marksheet

- Proof of Address: Voter ID card, Aadhar Card, Utility Bills

- Proof of Income: Salary slip, Income Tax Returns (ITR) details

- Identification proof: Permanent Account Number (PAN) card, Voter ID, Passport

- General power of attorney

- Property papers

- Last year ITR except for NRIs who belong to the Middle East countries

8. Bridged Loans

Bridged Loans are short term loans that are designed for existing homeowners who are planning to purchase a new property. It aids borrowers to fund the purchase of new house until a buyer is identified for the existing property. This type of loan usually requires the mortgage of new house with the bank and is extended for less than two years. Several banks like Vijaya bank and HDFC Bank offer bridged loans.

Eligibility Criteria for Balance Transfer Home Loans

Given below are the eligibility criteria for balance transfer home loans:

Age | Employment |

18 years to 70 years | All property owners and co-applicants |

Documents Needed for Loan for Construction of a House

Given below are the documents that are needed to apply for home purchase loan:

- Proof of Age: Birth certificate, Std.10 marksheet

- Proof of Address: Voter ID card, Aadhar Card, Utility Bills

- Proof of Income: Salary slip, Income Tax Returns (ITR) details

- Identification proof: Permanent Account Number (PAN) card, Voter ID, Passport

- Bank statement showing repayment of ongoing loan

- Property related documents

FAQs on Types of Home Loan

- Which bank provides cheapest home loan in India?

Union Bank of India, Bank of India and SBI are the banks that are offering attractive interest rates for self-employed professionals and non-professionals.

- Which bank is better for home loan government or private?

In comparison to a private lender, public sector banks will provide you a house loan with a considerably lower interest rate.

- Is it good take home loan from a private bank?

Private banks make it simpler to apply for a loan and to have it approved. The advantage of an online application process is also provided by private banks. You should consider things like: Bank processing fees while applying for a house loan from either of them.

- Is it better to take personal loan or a home loan?

With a home loan, you can borrow more money and pay it back over time. Since personal loans are unsecured, lenders typically provide significantly lower amounts, making it difficult to purchase a home with one. Additionally, a personal loan has a much shorter repayment period.

- Why do bank provide home loans?

Lenders typically sell loans for two reasons. The first is to free up capital that can be used to make loans to other borrowers. The other is to generate cash by selling the loan to another bank while retaining the right to service the loan.

- What is the difference between a loan and mortgage?

Any financial arrangement where one party receives a lump sum and agrees to repay the money is referred to as a "loan." A mortgage is a specific kind of loan used to fund a property.

- Are loans cheaper than mortgages?

Yes. Loans are cheaper than mortgages.

- Can I buy a land using a home loan?

Yes, you can apply for construction loan which allows you to purchase a land and construct a house.

Disclaimer

Credit Card:

Credit Score:

Personal Loan:

Home Loan:

Fixed Deposit:

Copyright © 2026 BankBazaar.com.