CIBIL Report

Loading your search...

A CIBIL report is a comprehensive summary of your previous credit activities, including borrowings and repayments, bill payments, CIBIL score, etc.

What is a CIBIL report?

A CIBIL report is a document that contains your credit history. It is computed by TransUnion CIBIL, the first credit bureau in India. This report includes details about all your loans, such as home, auto, and personal loans.

It also covers information on your credit cards and bill payments. Additionally, it records enquiries made by lenders. Your CIBIL score, which reflects your creditworthiness, is also included in the report.

Components of a CIBIL Report

A CIBIL report contains six main sections. Let's learn about them in detail.

CIBIL Score: A CIBIL score is a 3-digit number that falls in the range of 300-900. It is calculated by the CIBIL credit bureau after taking into consideration factors such as credit history and repayment behavior. A CIBIL score in the range of 750-900 is considered as a good credit score.A higher CIBIL score suggests you have high creditworthiness. It increases your chances of getting a good deal on loan interest rates as well as credit cards.

Personal Information: As the name suggests, this section contains your personal information such as name, date of birth, and unique identification numbers like PAN and Aadhaar. You need to make sure that the personal details are accurate in the report. These details are reported to the bureau by the bank.

Contact Information: This section will have your mobile number, telephone number, residential address, and email address.

Employment Information: This section of the CIBIL report contains your employment information. It will specify the type of your occupation such as salaried, professional, or business. It will also mention your monthly or annual income as reported by banks.

Account Information: This is the most important section of your CIBIL report as it contains records of your credit accounts. It will mention the loans and credit cards you have taken. The report will also mention the lenders names and loan amounts. The report will record your defaults, late payments, amount overdue, current balance, date opened, and date of last payment.

It contains a month-on-month record of your payments toward your loan EMIs as well as credit card bills for up to the last 3 years. You should ensure that the loan details reflected in the account are accurate. Discrepancies in your credit report can reduce your chances of getting loan approval.

Enquiry Information:This section records all the enquiries made by lenders in the past. An enquiry takes place when a lender pulls out your CIBIL report from the bureau to check your creditworthiness. The date and purpose of the enquiry is also mentioned in the report. The enquiry amount is also recorded in the report. It is advised to avoid making multiple credit enquiries in a short span of time as it may trigger hard enquiries from lenders, making you appear credit hungry.

What are the Key Sections in Your CIBIL Report?

The key sections in your CIBIL report are listed below:

- Profile Information: Personal details, such as name, date of birth, gender, and ID numbers (e.g., PAN) reported by lenders.

- Contact Information: Addresses, phone numbers, and email addresses associated with your credit profile.

- Employment Details: Job and income information provided by lenders when accounts are opened.

- Account Information: The details listed under this section are all loans and credit cards, account status, balances, overdue amounts, and monthly payment history (up to 36 months).

- Enquiry Information: Shows recent credit enquiries made by lenders when you apply for loans or cards.

Importance of a CIBIL Report

Your credit score is a key factor lenders check to assess your reliability in repaying loans or credit card dues:

- Determines your eligibility: A higher score increases the likelihood of loan or credit card approval.

- Better interest rates: Banks and NBFCs may offer lower interest rates on personal loans and home loans to applicants with strong scores.

- Preferred score: Lenders typically look for a CIBIL Score of 760 or above for approvals.

- Low score impact: Scores below 700 may lead to application rejection or stricter loan terms, high interest, etc.

- Additional factors: Lenders also consider income, repayment capacity, debt-to-income ratio, employment history, and profession.

How can I check my CIBIL Report without Paying?

As per RBI's mandate in 2017, all the credit bureaus in the country are required to offer one free detailed credit report to consumers with credit history every calendar year. You can visit CIBIL's official website and get your CIBIL report.

Moreover, Bankbazaar also gives you the facility to check your Credit report

You can easily track your CIBIL Score and other credit bureau scores every month at no cost:

- Go to the ‘Credit Score Form’ on the Bankbazaar platform.

- Enter your details, such as name, gender, mobile number, and email.

- Click ‘Get Free Credit Report’.

- Verify using the OTP sent to your mobile.

- You will receive your credit score from multiple bureaus, including CIBIL.

To help you monitor your credit health, an account will be created to update and track your credit score monthly.

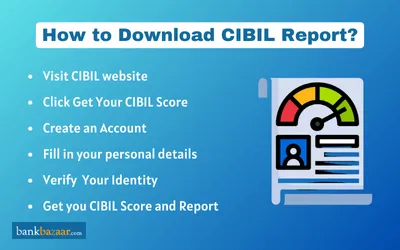

How to Download CIBIL Report?

Follow these steps to download your CIBIL report

- Go to the official CIBIL website.

- Click on the "Get Your CIBIL Score" option.

- This will redirect you to a page where you can request your CIBIL score and report.

- Fill in your personal details, including your full name, date of birth, mobile number, and email address.

- Confirm your details by correctly answering the security questions provided.

- Select the pricing option that suits your needs and make the payment.

- Once the payment is processed, you will receive an email with your CIBIL report.

- Open the email and follow the instructions to access your CIBIL report.

- Carefully review the report, checking for any discrepancies or errors.

- Should you come across any inaccuracies, reach out to CIBIL customer care support for assistance in resolving the issues.

Key Terms and Keywords that Feature on Your CIBIL Report

A CIBIL report is a summary of your detailed credit behavior. It consists of various sections that offer detailed information ranging from your personal information, home or auto loan availed, overdraft facilities, personal loan, and much more. In addition, the CIBIL report consists of your CIBIL score and history. There are several key terms and keywords that are present in your CIBIL report that will help you understand the report in a better way.

- Cash Limit: Cash limit refers to the amount of cash on your credit card that you are allowed to use.

- Amount Overdue: It indicates the total amount that has not been paid to the lender in a specific time.

- NA/NH: NA means No Activity while NH means No History. This means you have no credit history or not even a credit history to get scored. The NA/NH term also means you have no credit activity for a couple of years. Finally, it also suggests that you do not have any add-on credit cards and have no credit exposure.

- DPD: Days Past Due refers to the number of days that have passed since the due date of the payment. It must be noted that anything over zero or even Standard is bad.

- Written-Off Amount: When a loan is written off there is an interest and principal component. This field reflects the total interest and principal amount written-off.

- Written-Off and Settled Status: If the status of an account is mentioned as written off, it implies that the borrower was unable to pay the outstanding dues for more than 180 days and as a result, the lender has written off the unpaid dues. If the status of an account is mentioned as settled, it implies that, the borrower in consent with the lender, has partly paid the dues against the total outstanding amount.

- SMA: Special Mention Account refers to a special account created for reporting a standard account that is moving towards a sub-standard.

- CN: Control Number acts as a reference number in case there is some incorrect information in the credit report. It is presented at the top of the document.

- Repayment Tenure: It refers to the term of your loan. In order to understand it accurately, repayment tenure should be read with Payment Frequency.

- SUB: Sub-standard refers to accounts (loan/credit card) payments that are made after 90 days.

- LSS: It refers to the account where the loss has been identified and remains uncollectible.

- DBT: It means an account that has continued to remain in the sub-standard account status for 12 months.

- Actual Payment Amount: It is the amount you have paid the lender if it is different from the EMI amount. The actual payment amount can be higher or lower than the EMI amount.

- Current Balance: It refers to the amount that you still owe on a certain credit facility.

- STD: This entry is termed as (Standard) and is found against loan/credit card accounts, if the credit payments are made in a timely manner, or within 90 days from the due date.

Types of Loans That Impacts Your Credit Score:

Loans are of two types:

Secured Loans: These are loans like home loans, and auto loans and they are secured by a collateral.

Unsecured Loans: These loans are like personal loans and credit cards. You can avail yourself of these loans without a collateral.

Balanced Mix of Loans

- It is ideal to have a good balance of secured and unsecured loans. A balanced credit mix will positively affect your credit score. This will, in turn, increase the chances of you getting more loans in the future.

- If you have too many unsecured loans, this may negatively affect your credit score. This would mean that a lender will think that it is a high risk to give you a loan.

Benefits of Maintaining a Good CIBIL Score

Having a good credit score can benefit you in many ways:

- Higher chances of getting loans at lower interest rates.

- High chance of your loan application getting approved. This is because a high credit score reflects your creditworthiness.

- You will get access to pre-approved loans with a good credit score

- Your credit card application will also get approved fast

- You will get a discount on your processing fees

- You can get a higher credit card limit

CIBIL Customer Care

The customer care details of CIBIL re mentioned below:

- Contact CIBIL customer care via phone: Call +91-22-6140-4300 to connect to CIBIL customer care. You can call this number from Monday to Friday (10:00 a.m. to 6:00 p.m.)

- Email ID: You can also contact the customer care by writing email to CIBILinfo@transunion.com by mentioning the following the details: Name, Date of Birth, Gender, Contact Number, Identifier details, such as PAN, driving license, voter ID, etc. and Address (Permanent or Residence).

- Contact CIBIL customer care via fax: The CIBIL customer care fax number is +91 - 22 - 6638 4666

- Contact CIBIL customer care by visiting the corporate office or by writing to them(Write to their mailing address):

- TransUnion CIBIL Limited

- (Formerly: Credit Information Bureau (India) Limited)

- One Indiabulls Centre, Tower 2A,

- 19th Floor,Senapati Bapat Marg, Elphinstone Road,

- Mumbai - 400013

Disclaimer

Display of any trademarks, tradenames, logos and other subject matters of intellectual property belong to their respective intellectual property owners. Display of such IP along with the related product information does not imply BankBazaar's partnership with the owner of the Intellectual Property or issuer/manufacturer of such products.

Read More on CIBIL Report

- Know the factors that affect CIBIL Score

- Mistakes That can negatively impact your CIBIL Score

- Hidden facts about CIBIL Score

- CIBIL Myths

- CIBIL Redressal Process

- Are you in a credit card debt?

- What is considered as bad credit scores

- Pay Education Loan or Your CIBIL Score Suffer

- Are you in a credit card debt?

- Credit Healthy during the COVID-19 Crisis

FAQs on CIBIL Credit Report

- How do you correct errors in your CIBIL credit report?

RBI has made it mandatory for banks to comply with an individual's desire to access his or her credit report. If a bank declines a credit card or loan application, you can ask for the control number of your CIBIL credit report. You can then contact CIBIL at info@cibil.com and communicate details of errors in the report

- Do I need a form to apply for a CIBIL credit report?

Yes, you need to apply for credit reports using forms published by CIBIL. You can get these forms from their website.

- I don't want my CIBIL TransUnion Score, just the credit report. Is that possible?

Yes, if you want just the credit report then you can apply for it without having to take the TransUnion score along with it.

- How long does it take for the CIBIL credit report to reach?

If you check your CIBIL score for free or purchase any of the subscriptions plan online, you can access your report instantly upon successful authentication. In case of unsuccessful authentication, you will need to upload your KYC documents for verification. Upon verification, your CIBIL credit report will send to your registered mailing address in 7 business days via Courier/ Speed Post/ Express Delivery.

- What are the documents required for the CIBIL credit report?

Along with the application form, you will need to send an ID proof and an address proof. This applies even to companies; to whose case you will have to send the ID and address proof of the authorised signatory.

- Is there any time stipulation on when the supporting documents should reach CIBIL?

Yes. The supporting documents, ID and address proof should reach CIBIL within 7 days of your application for the generation of a credit report.

- How will the report be sent to me?

It will be sent within 7 business days via Courier/ Speed Post/ Express Delivery.

- What happens if I am not there to receive the report?

The delivery service will make only two attempts to deliver the report to your address. If you are not there to receive it a second time then it will be returned to CIBIL and you will have to apply for the report all over again.

- What happens if I have made mistakes on the application form?

CIBIL will tolerate up to 3 mistakes on the credit report. If you make more than 3 mistakes, then your application will not be processed.

- What if I send the wrong details by mistake?

f your details are wrong but match another person, then the report will be generated and sent to them at your cost.

- What happens if the address in my CIBIL account and the address proof don't match?

If your address proof does not match the one that CIBIL has on record, then your application will not be processed. You can update your address by sending KYC documents along with any other supporting documents needed.

- How can I pay for the credit report?

You can pay for the credit report using a demand draft, credit card, debit card or through net banking.

- Can I improve my credit score?

Yes, you can always improve your credit score by paying your bills on time, maintaining a healthy credit mix, keeping balances low, and keeping a check on credit history regularly.

CIBIL Score Requirements for Loans

Disclaimer

Credit Card:

Credit Score:

Personal Loan:

Home Loan:

Fixed Deposit:

Copyright © 2026 BankBazaar.com.